Sierra Madre Gold and Silver – Q2 2025 Financials And Operations, Mining Commenced At Coloso, Recent Financing Accelerates Future Growth

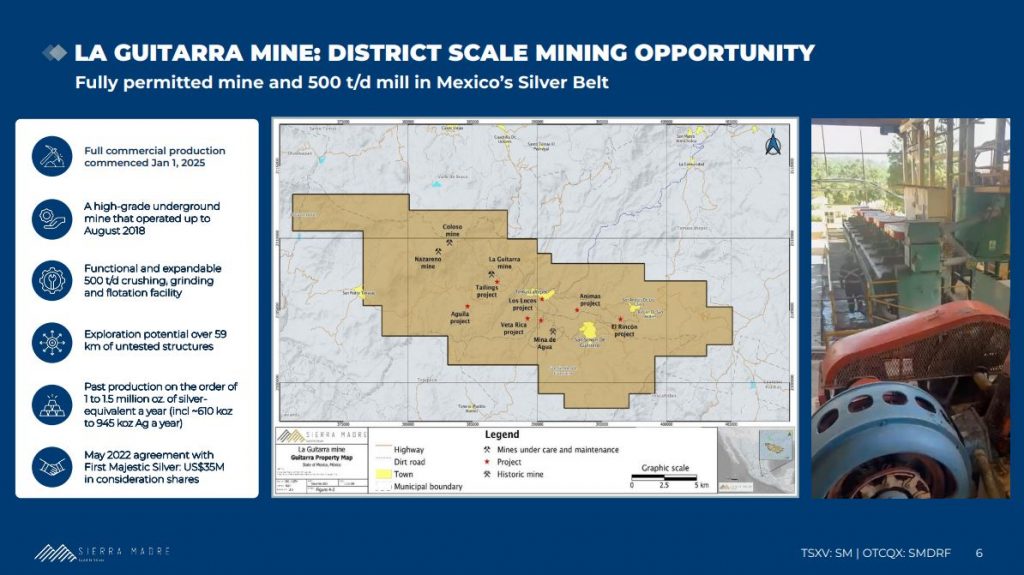

Alex Langer, President and CEO of Sierra Madre Gold And Silver (TSXV: SM) (OTCQX: SMDRF), joins us to review the Q2 2025 operations and financials showing profitability as the operations team continues fine-tuning the mining and milling processes at the site, at the La Guitarra Mine and processing plant, in Mexico. Additionally, production is ramping up at the higher-grade Coloso mining center, where dewatering and underground development are underway. We also discuss how the recent $19.5Million financing announced on July 31st, funds the future development and exploration value drivers for the Company across their district-scale land package.

Q2 2025 Highlights

- Net Revenues: Silver revenues for the quarter totalled $2.18 million ($33.20 per ounce) and gold revenues totalled $3.59 million ($3,271 per ounce).

- Net revenues for Q2 2025 increased by 10.7% to $5.36 million or $30.87 per AgEq ounce sold as compared to $4.84 million or $29.32 per AgEq ounce in the quarter ended March 31, 2025.

- Sales: In Q2, the Company sold 65,683 ounces of silver (“Ag“) and 1,096 ounces of gold (“Au“) or 173,562 silver equivalent (“AgEq“) ounces.

- Cost of sales was $4.07 million for Q2 2025, or approximately $23.45 per AgEq ounce sold as compared to $3.60 million, or $21.84 per AgEq ounce sold for Q1 2025.

- Adjusted EBITDA increased by 37.5% to $1.46 million for Q2 2025, compared to $1.07 million for Q1 2025.

- All-in-sustaining costs per AgEq ounce sold of $30.10 per ounce, compared to $28.98 in Q1 2025. In Q2 2025, production unit costs were impacted by the effects of an early onset of the Mexico rainy season and related power outages on production volumes, wage increases, increased depreciation and depletion.

- Gross Profit was $1.29 million for Q2 2025 ($1.23 million in Q1 2025).

- Cash provided by operating activities was $1.00 million for the six months ended June 30, 2025 (“H1 2025“) and includes $535,000 generated in Q1 2025.

- Current assets, including cash, totaled $5.93 million at June 30, 2025 ($4.33 million at March 31, 2025).

- Closed C$19.5M Private Placement: On July 24th and July 31st, 2025 in two tranches.

- First Majestic Loan Extension: On May 30, 2025, the Company and First Majestic Silver Corp. agreed to extend the $5 million senior secured project financing loan for an additional twelve months to mature on May 8, 2027. All other terms of the agreement remain unchanged.

Additional Operational Details

- Mine Operations: Milled 41,235 tonnes of material, with silver recoveries averaging 76.62% and gold recoveries averaging 77.95%.

- Production: Produced 66,011 ounces of silver and 1,048 ounces of gold (vs. production of 70,176 ounces of silver and 1,001 ounces of gold in Q1 2025).

- Coloso Mining: On April 29th, mining at the high-grade Coloso Mine restarted within the Guitarra Complex with the first stope being brought into production.

- Equipment Purchases: In H1 2025, spent $764,000 to acquire mining and mobile equipment and refurbish underground equipment (including $378,000 spent in Q1 2025).

- Development: $113,000 spent on mine development in H1 2025.

- Exploration: spent $362,000 on exploration and evaluation activities in H1 2025, which includes capitalized concession fees.

Alex discussed how the C$19.5 million financing, supported by high-quality institutional shareholders, will be deployed in part to purchase additional equipment and implement improvements at the mine to reduce costs and increase production grades and volumes in the near-term. They are finalizing plans for a plant expansion to increase capacity up from the current 500 t/d run rate, and preparing for a significant exploration program at the East District concessions, which will include a drill program of over 25,000 meters.

The property hosts 8 different past-producing mines, with the first 2 priorities being to explore around the El Rincon and Mina de Agua mines. Additionally, there is a non-compliant 17 million ounce historic resource at the Nazareno Mine, and also solid underground infrastructure connecting to the nearby high-grade Coloso Mine, that First Majestic had put quite a bit of sunk cost into already.

If you have any questions for Alex regarding Sierra Madre Gold and Silver, then please email them to me at either Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Sierra Madre Gold and Silver and may choose to buy or sell shares at any time.

Investment disclaimer: This content is for informational and educational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Investing in equities and commodities involves risk, including the possible loss of principal. Do your own research and consult a licensed financial advisor before making any investment decisions.

Click here to follow along with the latest news from Sierra Madre Gold & Silver

.

.

Hi there Canuckski. I’ve been out of the house for a few hours and just came back and saw that news in my email feed. Wow!!

Personally, I have positions in both companies in my portfolio, like both management teams, like both sets of royalty assets, but haven’t really processed how I feel about them coming together into a larger royalty company yet.

This is all hitting me as new info, as it was just released this evening. Yes, I was just actually considering writing an article about it this evening, as I collect more information and reflect on this deal; but was very close to finishing a my final silver producers article and may wait another day to reflect more on this merger before publishing.

Most resource investors that track this tiny sector, figured there was going to be more consolidation in the royalty space between companies, so in that sense it isn’t a surprise. Additionally, I knew Elemental now had extra financial firepower with the support of their key strategic shareholder Tether to work on larger acquisition deals…. but dang, this the acquisition of a whole company!!

My first inclination is just to keep holding both my positions in Elemental Altus and EMX Royalty and let them combine into a larger position in the new combined Elemental Royalty Corp.

In a way this good because I’ve had a void to fill in the mid-tier royalty company segment in my portfolio ever since Sandstorm was acquired by Royal Gold. In that sense, this position will likely serve as that same kind of anchor mid-tier royalty position for me now, to take the place of the larger Sandstorm Gold position I used to have.

In general, I like that it is 2 positions I already own and appreciate, but I’m curious as to how they’ll extract value from all of EMX’s royalty generation business properties. Elemental still has some from when they acquired Altus, so maybe the could option those projects out to other mining companies, or maybe they could spin the whole royalty generation business out into a SpinCo more like what Orogen has at present.

_________________________________________________________________________________________

Elemental Altus and EMX to Merge to Create New Mid-Tier Gold Focused Royalty Company Elemental Royalty Corp.

September 4, 2025

I knew this would happen a couple of years ago. Maritime has two operating mills that are fully operational and NFG can truck their ore there! DT 🤣👍🫵

New Found Gold and Maritime Enter into Definitive Agreement to Combine; Combination Creates an Emerging Canadian Gold Producer

Good call Dick. Do you own either?

Ex, Sorry if I missed any previous posting you might have put out regarding the merger of Elemental Altus and EMX to Create a New Gold-Focused Royalty Co.

What are you thoughts?

I’ve done quite well with both, so am now wondering whether to hold or move some funds onward.